How to reduce customer drop-off with automated document collection

Table of Contents

[ show ]- Loading table of contents...

Stephanie Spangler

We've heard from so many fintechs, banks, and lenders how frustrating manual document collection can be. Every new applicant requires a custom email with specific requests, and then you're left waiting; hoping the correct documents are submitted.

When they aren't, the back-and-forth starts, adding more delays which usually causes the applicant to drop out of the process. It's a lot of work — but it doesn't have to be.

With Collect, you can streamline document requests, ensure the right documents are provided, and create a smoother, more secure experience for you and your applicants.

Take this self-guided, interactive product tour to see how Collect works, or keep reading! You can also view a full-screen version of this tour here.

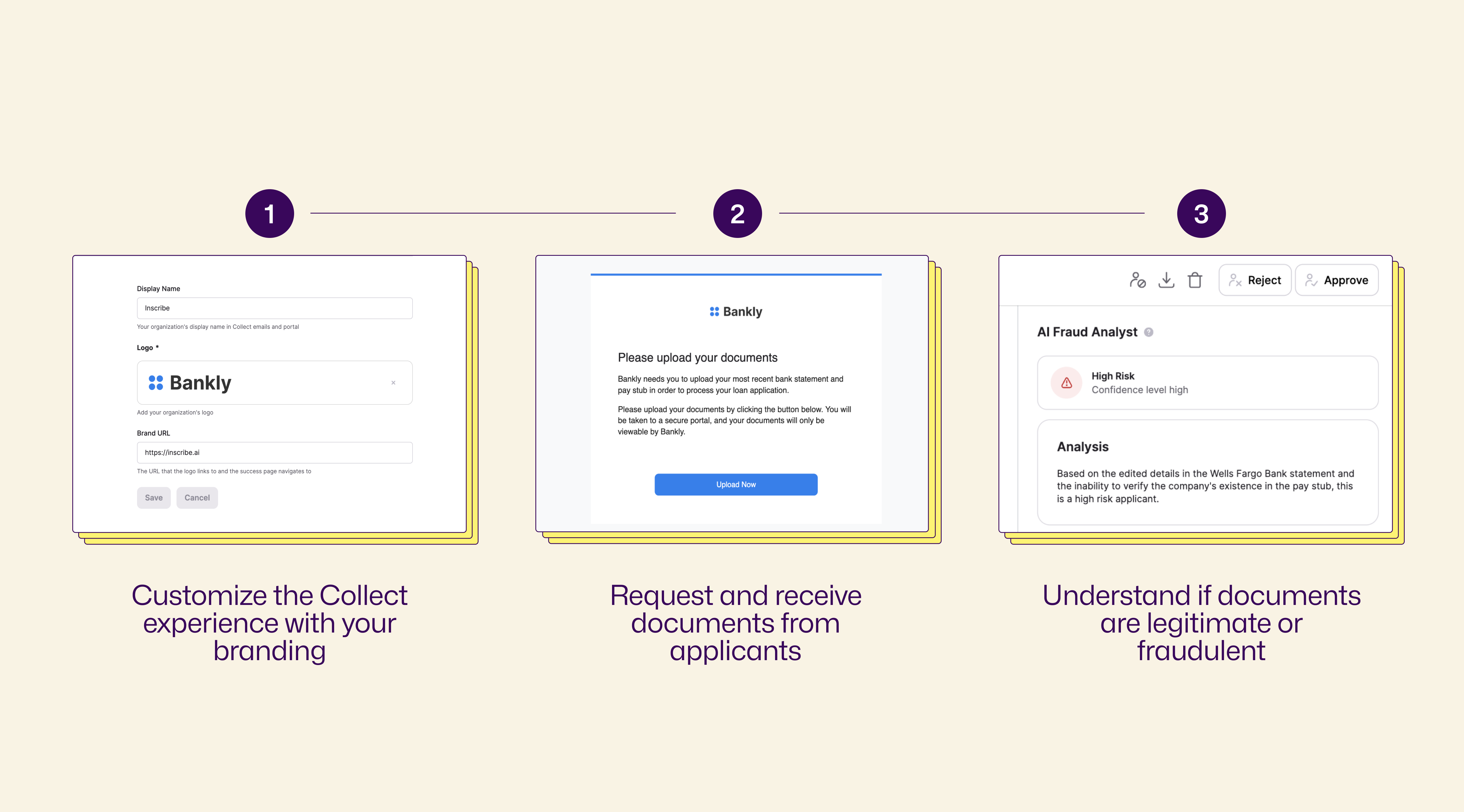

Here's how Collect works

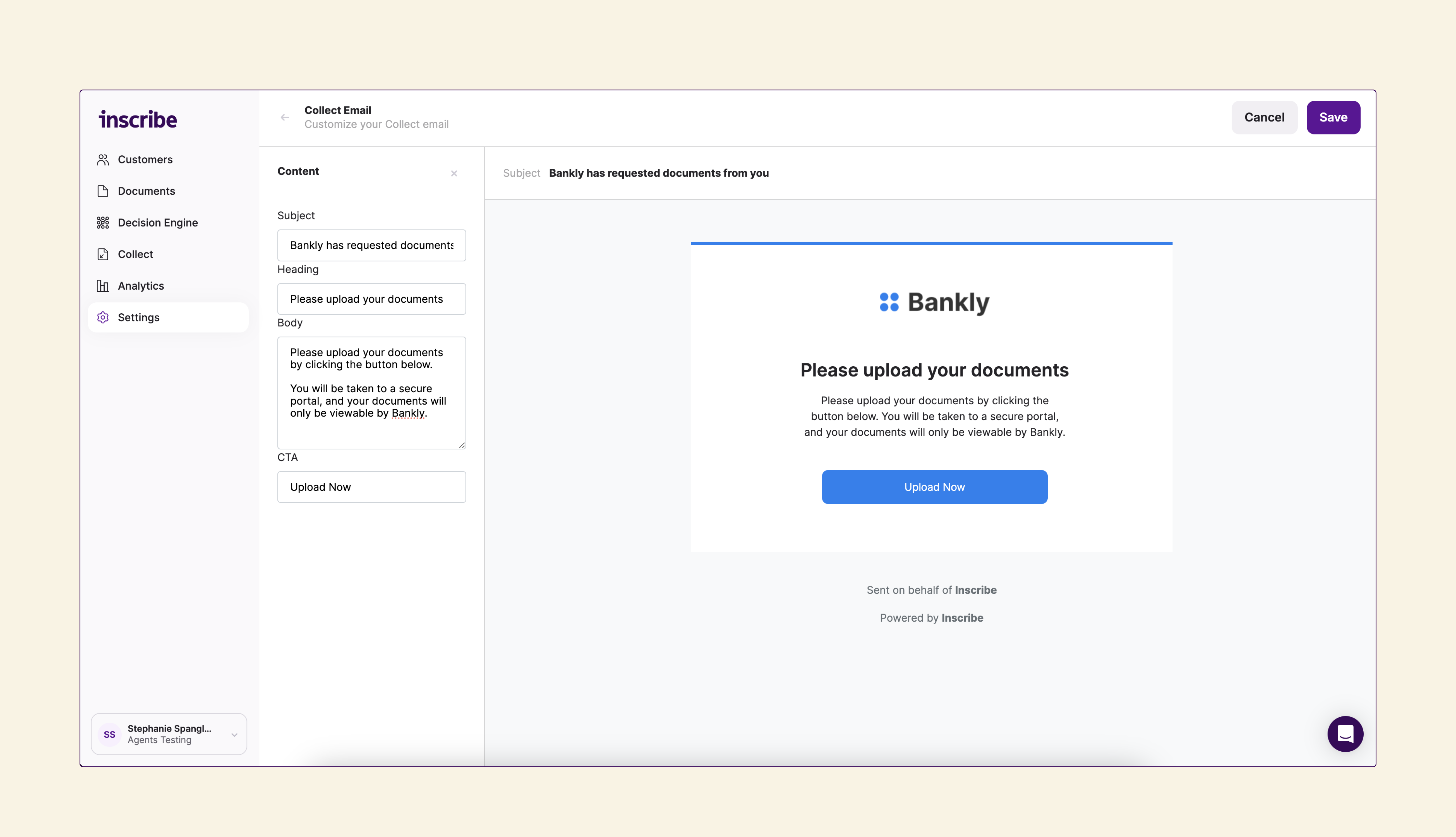

#1 Customize the Collect experience with your branding

Collect is fully customizable, allowing you to add your company's logo, colors, and custom text to the entire experience.

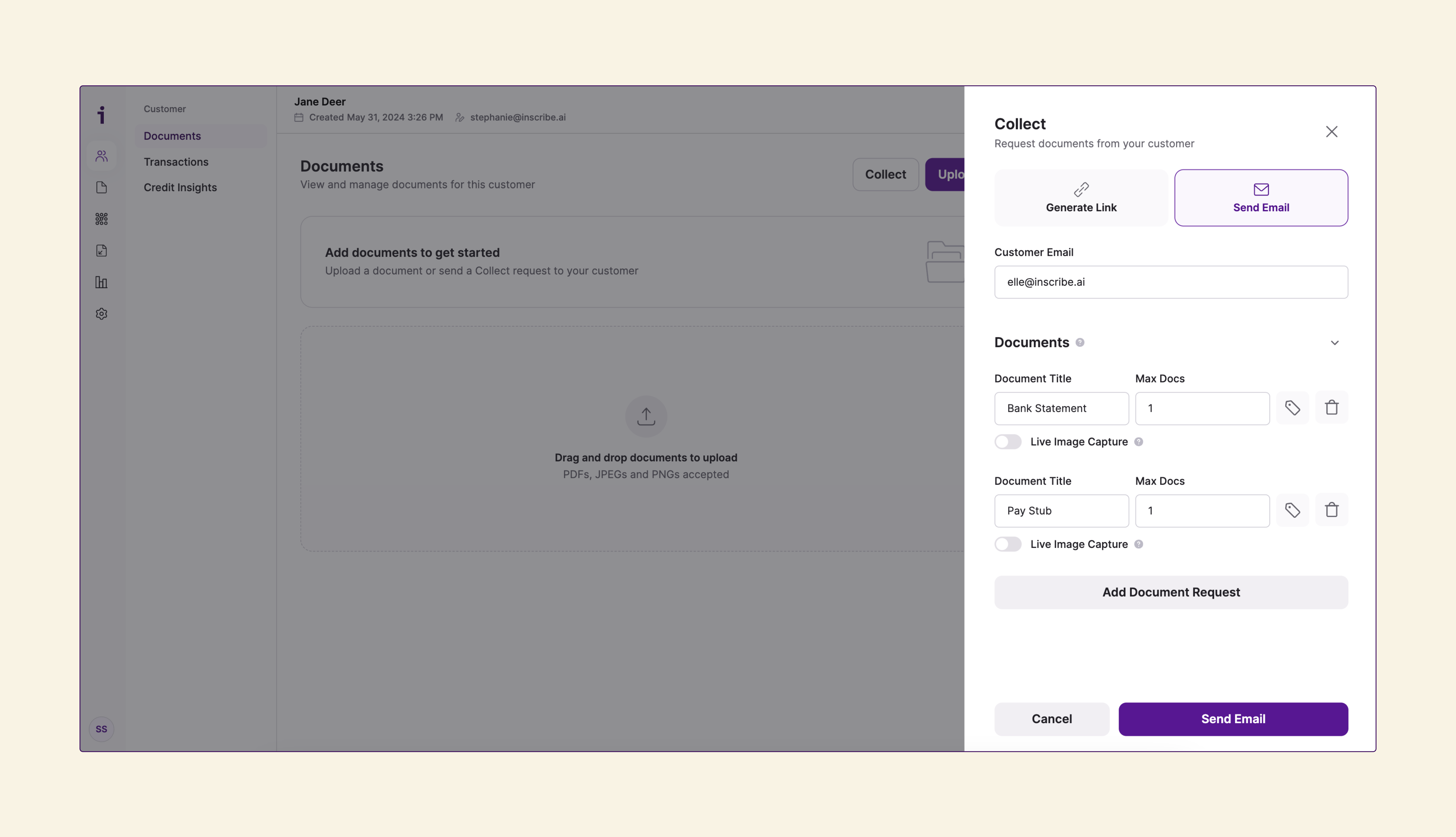

#2 Request & receive applicant documents from applicants

Once your customizations have been made, requesting documents from applicants is easy. From the customer view in Inscribe, you'll select 'Collect,' then specify the documents you need and how you want to send the request (via email or a shareable link).

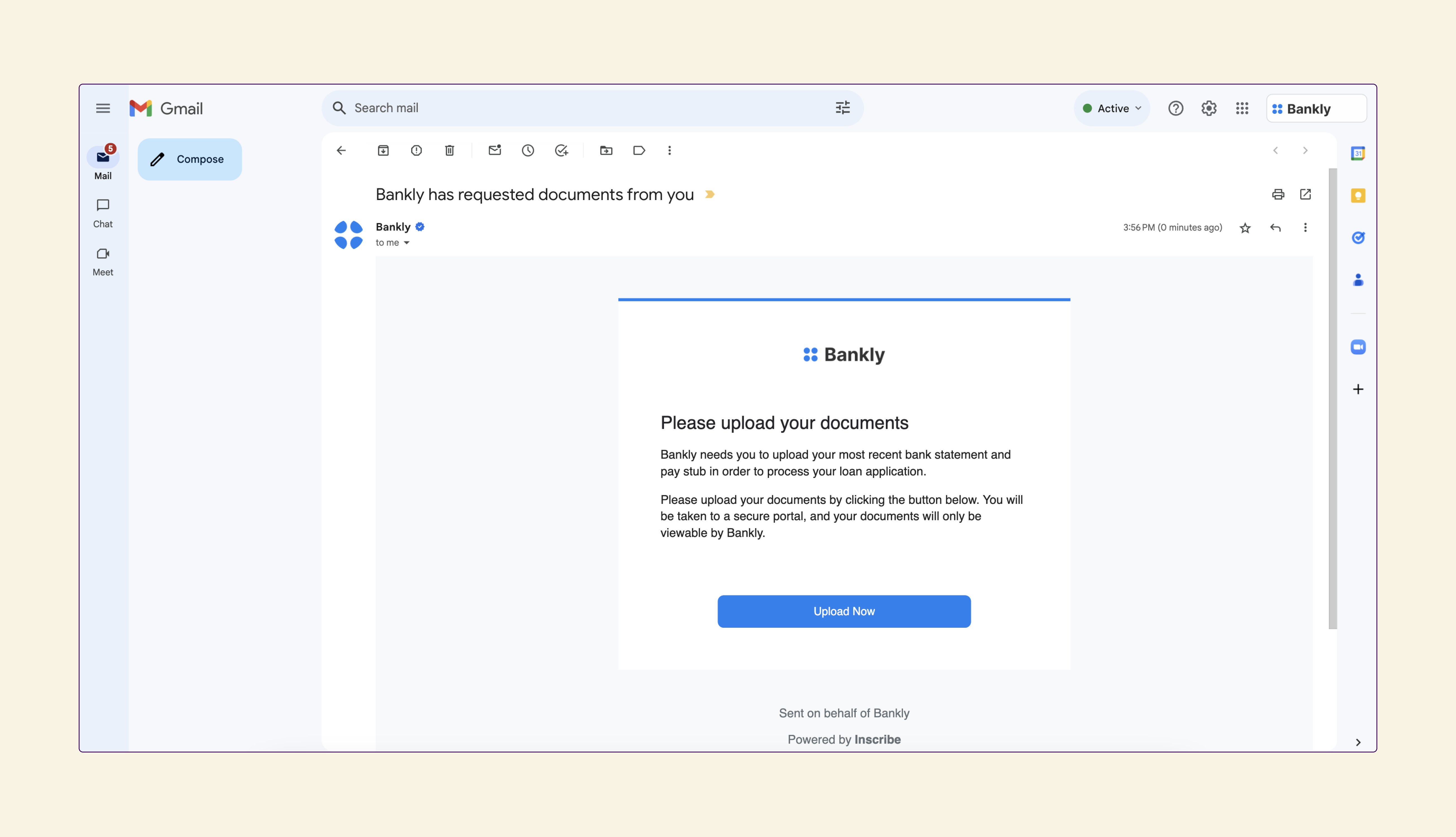

Your applicants will receive an email requesting the documents you need.

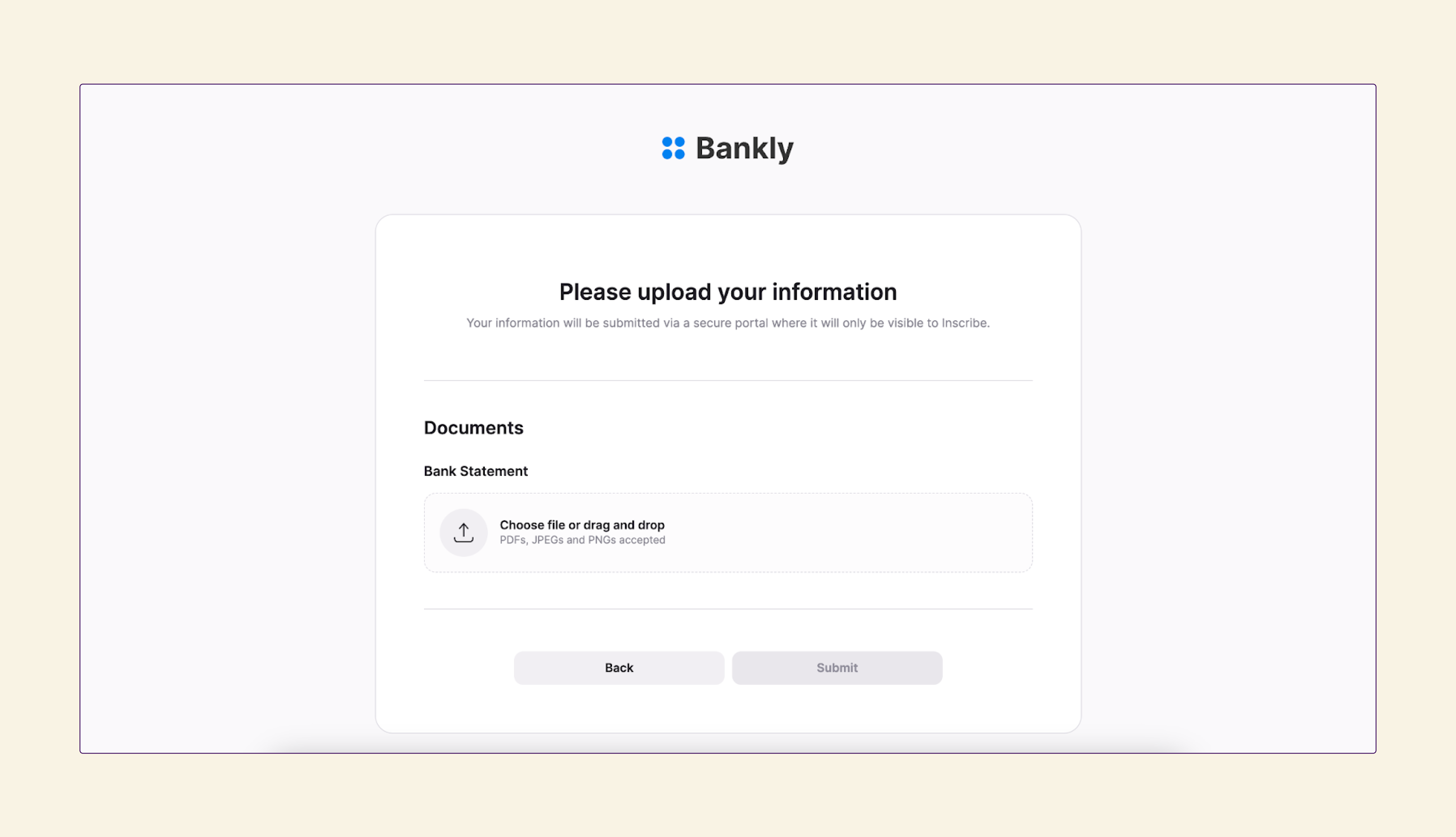

Whether the request is sent via email or a shareable link, applicants will be directed to this secure document collection portal. Here, they can easily drag and drop their documents for submission.

Since Inscribe allows you to verify uploaded documents, applicants will be notified if a document they submit doesn't meet your criteria. For example, you can require bank statements that are no more than 90 days old. If they upload an older document, Inscribe provides real-time feedback to help them understand the requirements, reducing delays and frustration.

Once the documents uploaded meet your requirements (if you specify them), applicants can easily submit their documents to you.

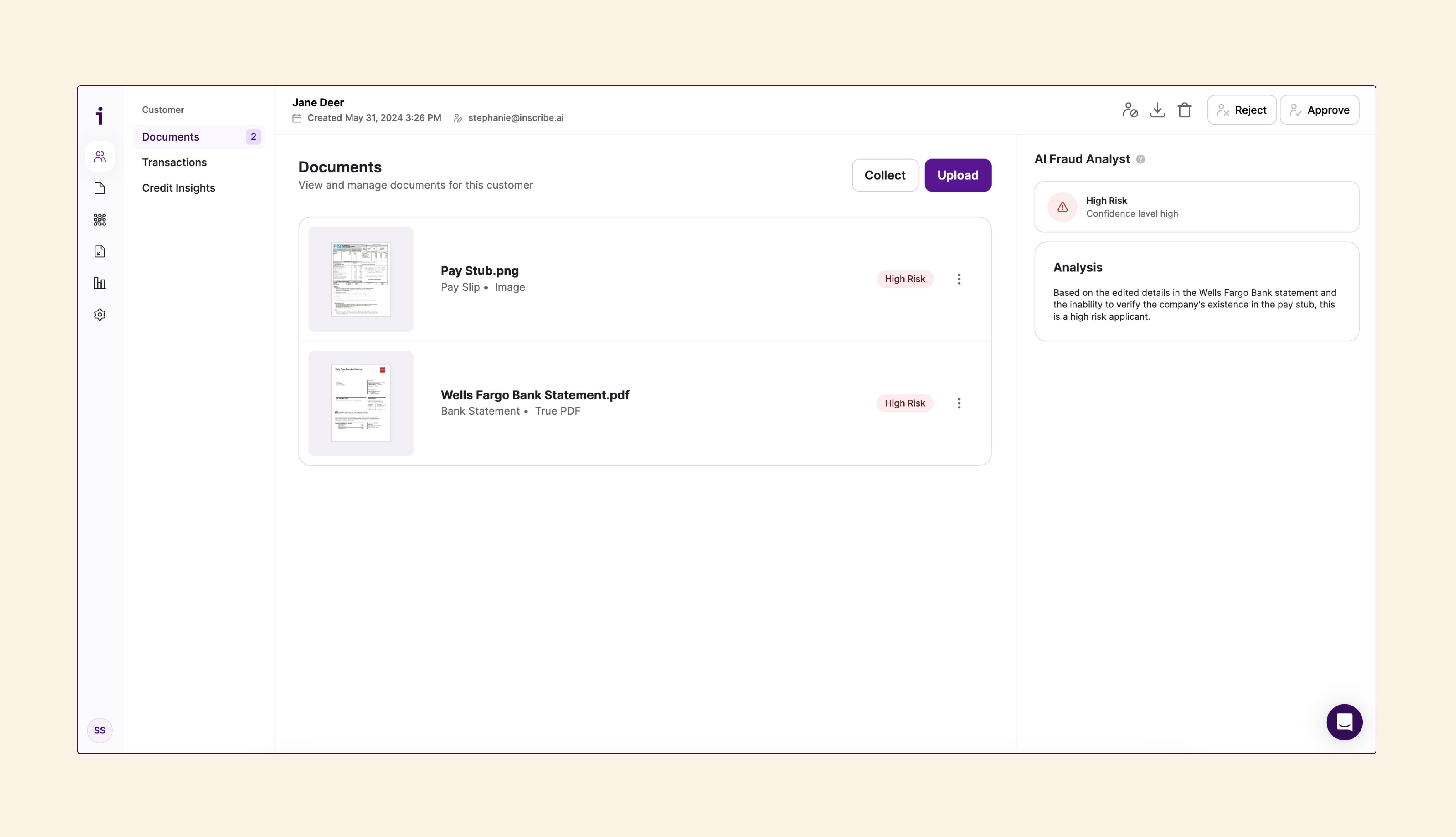

#3 Understand if documents are legitimate or fraudulent

Once applicants hit 'Submit,' their documents are uploaded to Inscribe, where our AI Agents immediately start checking for fraud, verifying details, and generating auditable risk reports. This allows you to skip manual document reviews and use the reports to quickly approve or reject applicants.

Inscribe also gives you the flexibility to integrate Collect into your existing processes via the API or embeddable iFrame, so you can create a truly custom and low-lift experience that fits your desired workflow.

Here's how one Inscribe customer reduced onboarding by 2 days with Collect

Gig Wage, a fintech business providing financial solutions to contractor-dependent businesses, reduced their onboarding time by 2 days after implementing Collect.

Challenge

Gig Wage was struggling with manual, labor-intensive onboarding processes, which slowed down customer onboarding and posed a risk for fraud. Each business applicant required a custom email for document requests, leading to delays, frequent back-and-forths, and a poor customer experience. Fraud detection was equally time-consuming and error-prone, leaving the team vulnerable to potential losses from fraudulent businesses.

Solution

By integrating Inscribe's API into their platform, Gig Wage automated document collection and screening, enabling a self-service onboarding experience for applicants. This transformed the manual process into an efficient, user-friendly workflow, allowing the fraud team to instantly screen documents and detect fraud with AI-powered tools.

Result

With Inscribe, Gig Wage reduced onboarding time by 2 days and achieved an 80% response rate to document requests. Fraud detection became faster and more accurate, cutting at least 30 minutes of admin work per application and saving over 150 hours annually. The automation improved customer satisfaction, reduced fraud risk, and allowed the company to scale more efficiently.

Ready to convert customers faster with automated document collection? Speak with a member of our team.

About the author

Stephanie Spangler is the Head of Product Marketing at Inscribe, where she leads efforts to promote AI-driven solutions for banks, fintechs, and lenders. Stephanie is a seasoned product marketing leader with over 15 years of experience in driving go-to-market strategies for B2B software companies. As a three-time founding Product Marketer, she has successfully launched and scaled products in competitive markets. With experience as a product marketing consultant and previous leadership roles at Sendoso and Sage, Stephanie is known for her expertise in market analysis, customer insights, and strategic product positioning.

What will our AI Agents find in your documents?

Start your free trial to catch more fraud, faster.