Unlock superhuman performance with AI Agents

Inscribe’s pre-trained AI Risk Agents are experts in performing onboarding and underwriting tasks. They can read, write, and reason like humans, but because they work 24/7, one AI Agent can easily perform the work of 70 human agents.

Video

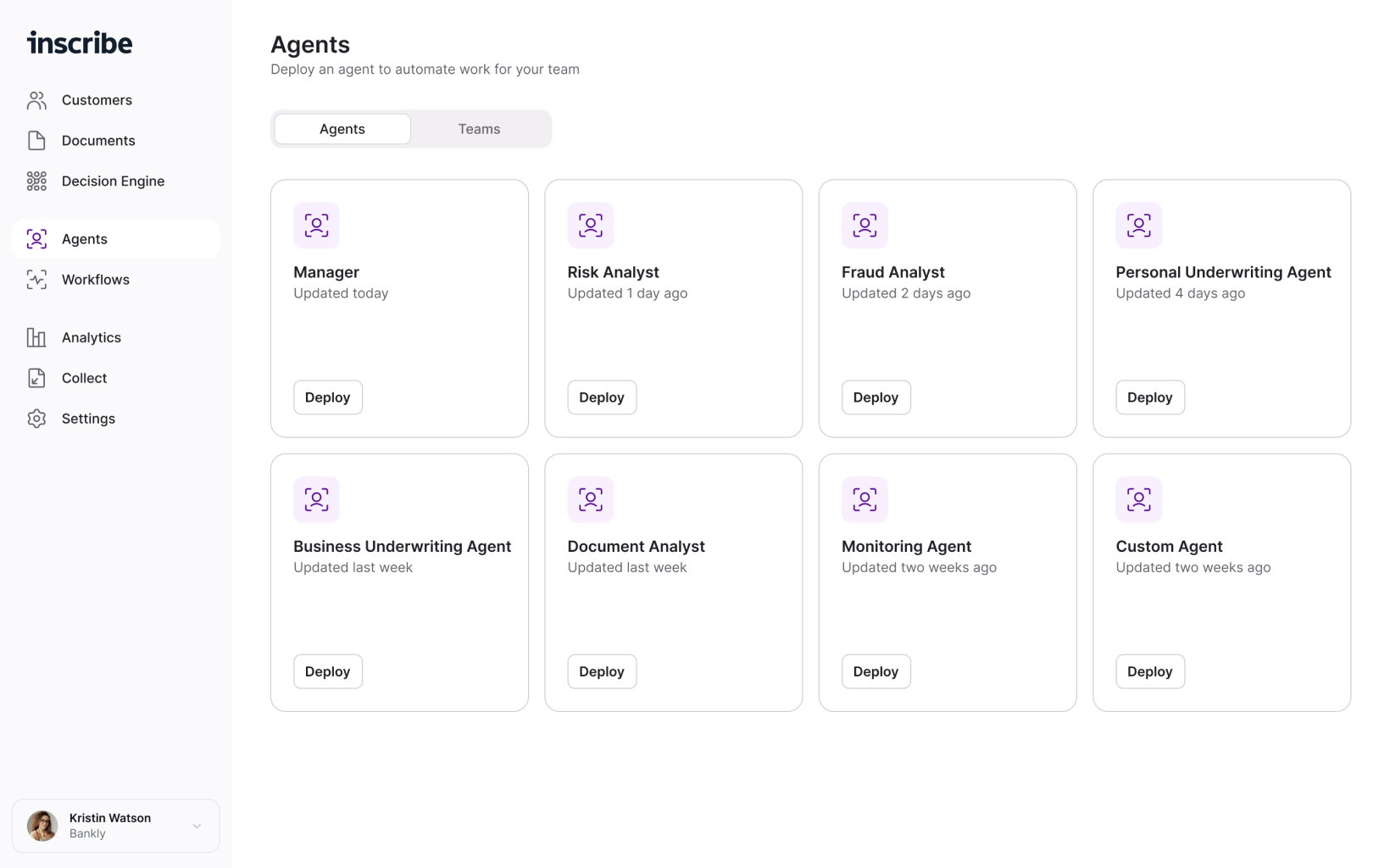

See what’s possible with AI Risk Agents

solution

AI Risk Agents you can use today

AI Fraud Analyst

Uncovers hidden document fraud and automates tedious research, so your team spends less time investigating and more time converting customers.

Learn More

AI Compliance Analyst (Beta)

Automates KYB checks using detailed document analysis and rich data sources, like Secretary of State records, for faster, safer, and more efficient onboarding.

Learn More

Why inscribe

Why risk teams choose our AI Agents

Specialized agents

Deploy our specialized AI Risk Agents to automate fraud and compliance tasks, so your team can focus on more complex cases.

Trusted AI experts

Inscribe’s entirely in-house team is made up of skilled data scientists, machine learning engineers, and fraud fighters with real-world experience in risk operations.

Built for risk teams

Since 2017, our machine learning models for document fraud detection, parsing, cash flow analysis, and more have been trained on real-world financial document data.

Resources

Demos, insights, and expertise

Dive into interactive product tours and recorded demos, gain insights from expert-led podcasts, and stay ahead with the latest trends in AI and innovation through our blog.

FAQs

01

What are Inscribe AI Risk Agents?

Inscribe’s pre-trained AI Risk Agents are experts in performing onboarding and underwriting tasks. Your team can deploy these AI coworkers to increase their outputs without increasing budget, resources, or headcount.

02

How do Inscribe AI Risk Agents assess risk?

Inscribe AI Risk Agents assess risk by analyzing data from various sources, such as transaction histories and application documentation, to identify patterns and anomalies that may indicate potential risks.

03

What industries can benefit from Inscribe AI Risk Agents?

Industries such as banking, lending, property management, e-commerce, and fintech can benefit from Inscribe AI Risk Agents for their ability to detect and manage risks related to fraud, compliance, and other operational concerns.

04

What use cases can benefit from Inscribe AI Risk Agents?

Inscribe AI Risk Agents can be deployed to complete workflows for business underwriting, consumer underwriting, mortgage lending, KYB, KYC, and many other use cases.

05

How do Inscribe AI Risk Agents help in fraud detection?

Inscribe AI Risk Agents detect fraud by identifying suspicious activities and patterns that could indicate fraudulent behavior. They can provide real-time alerts and recommendations for preventive actions.

06

How do Inscribe AI Risk Agents contribute to compliance?

Inscribe AI Risk Agents contribute to compliance by monitoring transactions and activities for adherence to regulatory standards, flagging potential violations, and helping businesses avoid penalties.

07

Can Inscribe AI Risk Agents adapt to emerging risks?

Yes, Inscribe AI Risk Agents can adapt to emerging risks by continuously learning from new data and adjusting their risk assessment models to stay current with evolving threats.

08

What measures does Inscribe take to ensure data privacy?

Inscribe ensures data privacy through robust data encryption, access control, and compliance with data protection regulations to safeguard sensitive information used by their AI Risk Agents.

09

How do Inscribe AI Risk Agents provide actionable insights?

Inscribe AI Risk Agents provide actionable insights by generating reports, alerts, and recommendations based on their analysis of risk data. This helps businesses make informed decisions to mitigate risks.

10

What support does Inscribe offer for businesses using AI Risk Agents?

Inscribe offers support through customer service, training, and consultation to help businesses integrate AI Risk Agents effectively and achieve the best results in risk assessment and management.